Unknown Facts About Best Investment Books

Wiki Article

The most beneficial Expenditure Books

Serious about turning out to be an even better investor? There are several books that will help. Prosperous buyers read through extensively to create their abilities and remain abreast of emerging tactics for financial investment.

Some Of Best Investment Books

Benjamin Graham's The Smart Trader is really an indispensable guidebook for any Trader. It handles every little thing from elementary investing techniques and risk mitigation tactics, to worth investing procedures and techniques.

Benjamin Graham's The Smart Trader is really an indispensable guidebook for any Trader. It handles every little thing from elementary investing techniques and risk mitigation tactics, to worth investing procedures and techniques.one. The Little Book of Widespread Feeling Investing by Peter Lynch

Published in 1949, this vintage do the job advocates the worth of investing having a margin of security and preferring undervalued shares. A necessity-read through for anybody keen on investing, specially These on the lookout beyond index money to identify precise substantial-worth very long-term investments. Also, it handles diversification ideas along with how to avoid remaining mislead by current market fluctuations or other Trader traps.

This reserve provides an in-depth manual on how to grow to be An effective trader, outlining each of the principles just about every trader should really know. Topics reviewed within the guide range between market psychology and paper investing techniques, preventing typical pitfalls including overtrading or speculation plus more - building this ebook essential reading through for serious investors who want to assure they have an in-depth familiarity with basic buying and selling principles.

Bogle wrote this in depth ebook in 1999 to drop gentle around the hidden costs that exist within just mutual resources and why most buyers would gain extra from purchasing very low-rate index funds. His information of preserving for rainy working day cash although not putting all of your eggs into 1 basket along with buying economical index resources continues to be valid these days as it absolutely was back then.

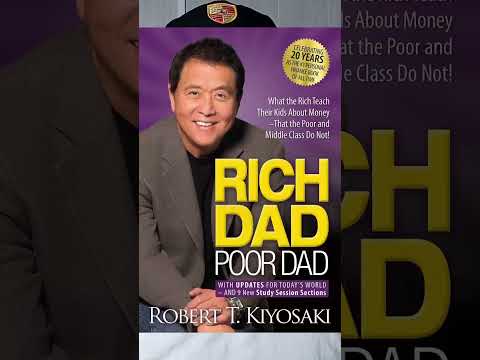

Robert Kiyosaki has lengthy championed the value of diversifying income streams through property and dividend investments, specifically property and dividends. Though Abundant Father Poor Dad might drop a lot more into personal finance than individual improvement, Wealthy Father Weak Dad remains an instructive go through for any person wishing to raised understand compound interest and the way to make their dollars operate for them as an alternative to in opposition to them.

For some thing far more modern, JL Collins' 2019 book can provide some much-needed standpoint. Meant to deal with the demands of economic independence/retire early communities (FIRE), it concentrates on reaching monetary independence via frugal dwelling, low price index investing along with the 4% rule - as well as strategies to scale back scholar financial loans, put money into ESG property and take full advantage of on line expense means.

two. The Very little Guide of Stock Marketplace Investing by Benjamin Graham

Thinking about investing but Uncertain the way to commence? This reserve features useful direction published specifically with young traders in your mind, from sizeable pupil loan personal debt and aligning investments with personalized values, to ESG investing and on the internet fiscal means.

This best investment guide exhibits you how to establish undervalued shares and establish a portfolio that should offer a continual supply of money. Employing an analogy from grocery searching, this best guide discusses why it is much more prudent to not give attention to expensive, very well-marketed goods but rather think about minimal-priced, disregarded ones at revenue costs. On top of that, diversification, margin of basic safety, and prioritizing worth more than progress are all talked about thoroughly in the course of.

A traditional in its subject, this reserve explores the basics of worth investing and how to determine possibilities. Drawing upon his financial commitment business Gotham Funds which averaged an once-a-year return of 40 % through 20 years. He emphasizes averting fads whilst obtaining undervalued businesses with sturdy earnings prospective customers and disregarding brief-expression industry fluctuations as significant rules of thriving investing.

This ideal expenditure reserve's creator presents guidance For brand spanking new buyers to avoid the faults most novices make and maximize the return on their own revenue. With stage-by-phase Recommendations on creating a portfolio created to steadily expand over time plus the writer highlighting why index funds deliver essentially the most economical suggests of expenditure, it teaches viewers how to keep up their system in spite of current market fluctuations.

Getting My Best Investment Books To Work

Whilst 1st posted in 1923, this guide continues to be an priceless manual for any person considering managing their finances and investing correctly. It chronicles Jesse Livermore's encounters - who attained and lost millions in excess of his lifetime - although highlighting the significance of probability theory as Element of choice-producing procedures.

Whilst 1st posted in 1923, this guide continues to be an priceless manual for any person considering managing their finances and investing correctly. It chronicles Jesse Livermore's encounters - who attained and lost millions in excess of his lifetime - although highlighting the significance of probability theory as Element of choice-producing procedures.When you are seeking to enhance your investing expertise, you can find many terrific guides on the market that you should select. But with constrained hrs in per day and minimal obtainable reading through product, prioritizing only People insights which offer essentially the most price may be demanding - Which explains why the Blinkist app supplies this sort of quick access. By accumulating crucial insights from nonfiction publications into Chunk-sized explainers.

three. The Minor E-book of Value Investing by Robert Kiyosaki

Best Investment Books Can Be Fun For Everyone

This ebook covers purchasing corporations with an financial moat - or aggressive edge - for example an economic moat. The author describes what an financial moat is and gives samples of a lot of the most renowned firms with one. Also, this e book information how to ascertain a company's worth and purchase stocks In keeping with cost-earnings ratio - ideal for rookie buyers or everyone desirous to discover the fundamentals of investing.

This ebook covers purchasing corporations with an financial moat - or aggressive edge - for example an economic moat. The author describes what an financial moat is and gives samples of a lot of the most renowned firms with one. Also, this e book information how to ascertain a company's worth and purchase stocks In keeping with cost-earnings ratio - ideal for rookie buyers or everyone desirous to discover the fundamentals of investing.This doorstop investment decision ebook is both of those well-known and thorough. It covers lots of the finest methods of investing, including starting up young, diversifying commonly and not shelling out high broker costs. Prepared in an engaging "kick up your butt" fashion which can both endear it to audience or flip you off absolutely; whilst masking a lot of frequent items of advice (commit early when Other people are greedy; be wary when Many others turn out to be overexuberant), this textual content also recommends an indexing strategy which heavily emphasizes bonds when compared with lots of identical methods.

This ebook presents an insightful method for inventory buying. The author describes how to select successful shares by classifying them into 6 distinctive groups - gradual growers, stalwarts, quickly growers, cyclical stocks, turnarounds and asset performs. By subsequent this straightforward program you increase your odds of beating the industry.

Peter Lynch is without doubt one of the planet's more info premier fund administrators, getting operate Fidelity's Magellan Fund for 13 years with a mean return that defeat the S&P Index each and every year. Revealed in 2000, his guide highlights Lynch's philosophy for choosing shares for specific investors in an obtainable method that stands in stark distinction to Wall Street's arrogant and extremely technical solution.